Budget: How to Create a Stellar Financial Plan

We have figured out why we need a budget how to go about categorizing our spending and hopefully you have printed out my budget workbook. Now, it is time to sit down and work on creating a budget for your life.

I use a zero-based system, so that is how I will be discussing budgeting throughout this post. When you give each dollar a name, you are more likely to stick to what you plan. Why? Because you are giving yourself permission to spend and save. That takes some of the decision fatigue surrounding money out of the equation.

Where do you start with a Budget?

I will suggest that you go over to the spreadsheet that I have created in order to start your budget. You are going to want to pull out your spend tracking categories list, and you are going to want to see if there is anything different on your list than what I have pre-filled in the budget worksheets.

Remember, this is a budget for YOU. It is not for me. In order for you to have the most success with your financial plan, it needs to be individualized. The best way to do that is for you to go into that spreadsheet, and change the names of categories. Instead of “cell phone,” put the particular company you pay. If you rent, delete “mortgage.” If you do not have certain bills and expenses, delete them from my spreadsheet. And if you have expenses or categories that I have not included, add those in.

Once you have all of your categories as you would like them in the spreadsheet, you are going to want to put your income down at the bottom. This is going to help you see how your budget adds up overall. You are going to see whether you have extra money at the end of the month that then needs to be put in another category, or you are going to see that you are over and need to make adjustments.

Making Adjustments to your Budget

If you are over on your budget, and need to make some cuts, the easiest place to start will be with non-essential expenses. Your essential expenses are going to be housing, utilities, food, transportation.

Remember, we want to use realistic numbers, which is why you needed to print out your financial statements in order to see how much you are currently spending. Of those purchases, are there places you can cut back? Are there incidentals that you are purchasing each month that are not needs, but instead wants? Cut those things first.

If you are under what your income is for the month, that is amazing! However, if you don’t assign that money a place to go, it is very easy to spend it on frivolous things that don’t really matter. I’m not telling you that you can’t buy some fun things, but rather understand how many fun things you are actually buying. Remember, it is the little purchases that tend to add up to a lot of money disappearing from your bank account. Do you need to get coffee out every day? Is takeout several times a week the necessity? Just because you have the money to do those things does not mean that you should – hard facts, I know.

What are the Goals with using a Budget?

The purpose of the budget is to know where your money is going. But, it is also about making smart choices with money. Are there things that you want to do longterm that cost money? I’m going to say 100% of you will answer yes.

There are so many future things to think about, it can be overwhelming sometimes. That is why it is easy to spend that extra money, or to not regard it with as much power as it could actually have. So what are some of the future things you may be giving up if you spend frivolously now?

- Vacations

- Retirement Savings

- Replacement cost of big ticket items

- College for your kids

There are all kinds of down-the-road expenses that we should be thinking about now, even if we don’t have a lot of extra leftover at the end of the month, or even none.

Challenges with Budgeting

The biggest challenge with budgeting is when you don’t have enough money at the end of the month. Believe me, I have been there. When I was pregnant with my oldest I thought we were doing really well – and we were in a sense. My husband and I were both working full-time, and the only debt we had were student loans and a car loan. Granted, those student loans were close to 100K for my husband and I. But, we had plenty of money leftover at the end of the month, and it was totally fine.

Then, I had my first baby, I had my maternity leave, and I realized I did not want to go back to work. I wanted to stay home. That was never the plan, and we jumped in with both feet and zero prep. At that point, I was making more money than my husband, and I just gave it all up to stay home.

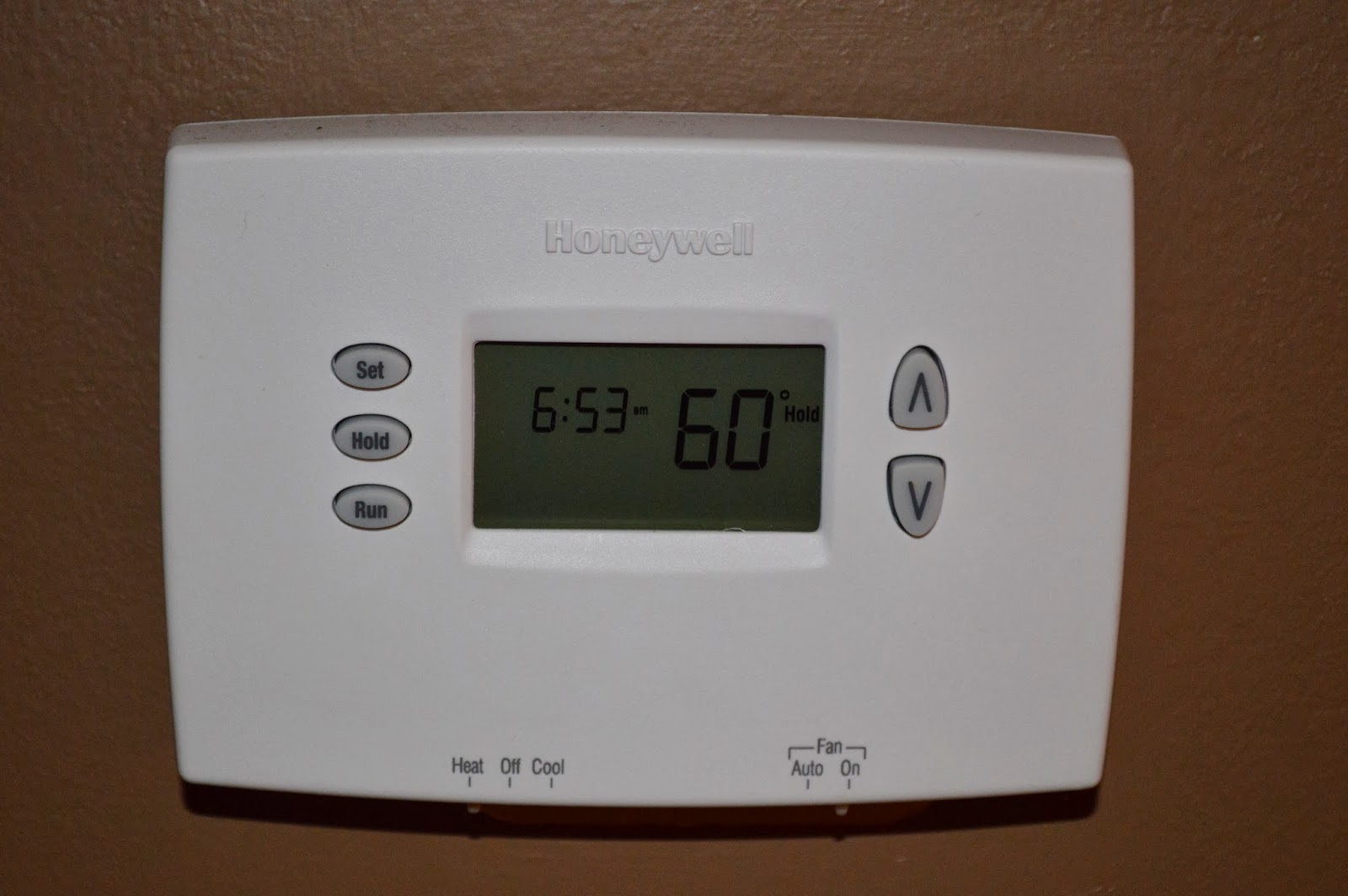

I was budgeting, we were still paying our bills, but all of a sudden everything got incredibly tight. We had to start making sacrifices that were kind of big – turning our heat down in the winter, becoming a one-car household, making all of our cleaning supplies from scratch, never eating out, eating a lot of meals that consisted of rice and beans. I became incredibly frugal out of necessity. The choices are hard, but they can be done.

The Budget Game

The budget game is really a game of balancing. Balancing what you really need and still being able to add in some wants. You may be in a season where you need to make all the cuts. Believe me, I get it. For years we were in that season. It took a long time to dig out of it. But, consistent care of the budget and managing the money that we did have was the thing that helped us the most.

It isn’t fun when you don’t have enough money to do the things that you want, but you can make it fun by challenging yourself to spend as little as possible on some of those necessary categories in order to have a little bit leftover for fun. And eventually, you will get to a point where you understand what your true needs are in a given month, and will be able to plan accordingly.

The Bottom Line

Creating a budget takes a lot of work, and oftentimes adjustments will have to be made. But, when you take the time to pay attention to the money that is coming in and going out, you will have more controls in place to be able to manage your money well. And once you get to a point of understanding your income and expenses, you will be able to move forward with your financial goals.

Don’t give up if your budget doesn’t work the first month. It is a process to come up with the right numbers. Going through your financial statements for previous months is only the first step to give you realistic numbers to work with. Once you dig deep and consistently track your spending, you will see exactly what you need. And then, once your year is complete, you will see how much you spend in your different categories. That is when you will be able to make a realistic budget for the next year, because you will have gone through one entire year, tracking your spending in different categories, and understanding exactly where your money is going.